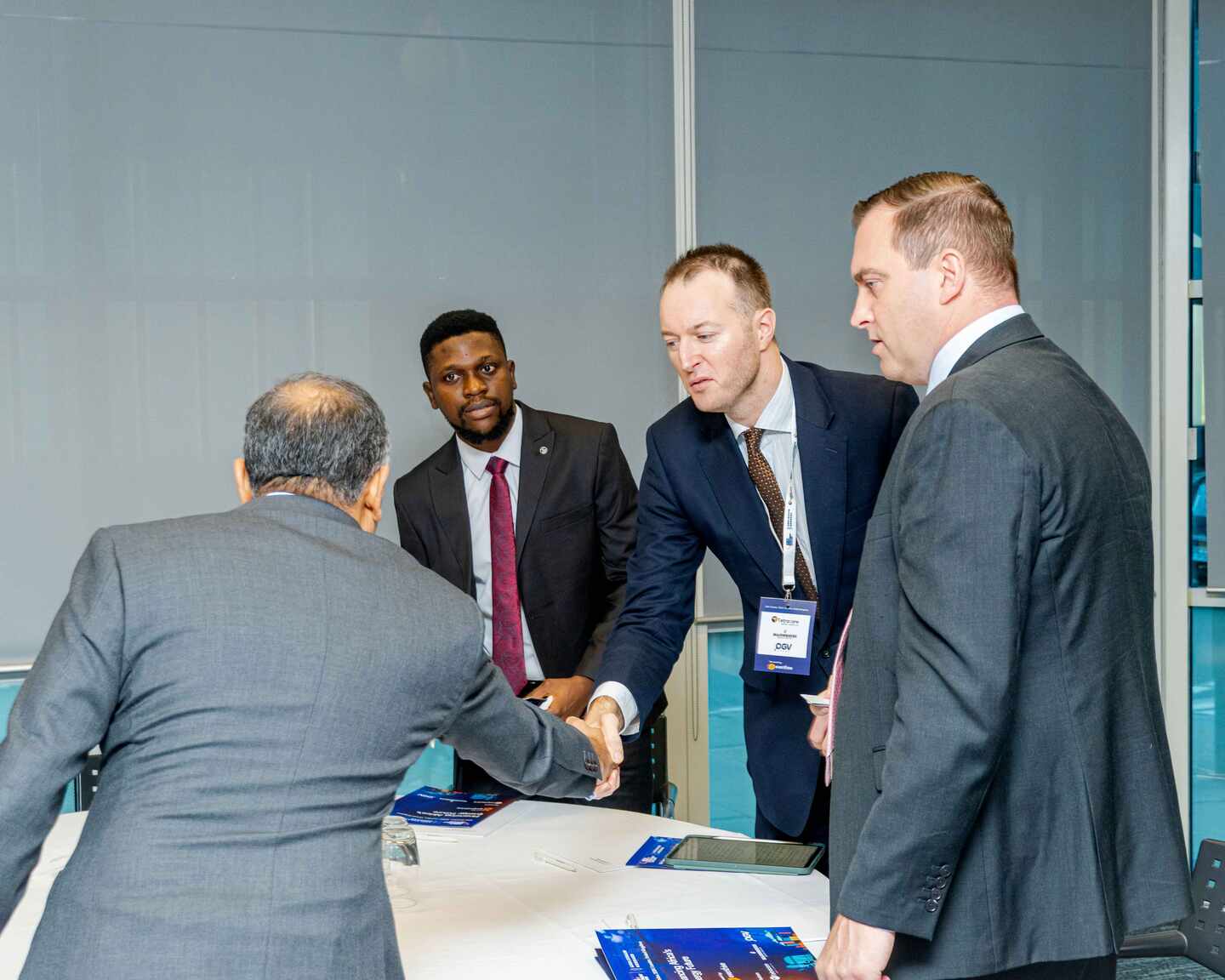

The New Investment Reality: Redefining UK-Africa Capital Flows

Speakers will assess how macroeconomic reforms, risk mitigation tools, and blended finance mechanisms are making African opportunities more investable, and how the UK’s investment institutions can play a catalytic role in driving this momentum.

Key Focus Areas:

- UK-Africa Investment Landscape: Assessing the new contours of capital flow between London and African markets.

- Blended Finance and DFIs: Leveraging partnerships between DFIs, private investors, and governments to de-risk large projects.

- Sector Priorities: Infrastructure, energy transition, fintech, and manufacturing as key growth frontiers.

- Macroeconomic and Currency Risks: Practical approaches to hedging and managing volatility.

- UK’s Competitive Edge: How UK financial expertise, innovation, and ESG credentials can redefine investment engagement in Africa.